By Barbara Cerda, Contributer

Winds sent old newsprint flying like white kites caught in the updraft along the empty concrete corridors of Wall Street on October 29, 1929. The world had just begun to feel the horrendous pain of the Great Depression. It would last for more than a decade before the monetarist would be able to steer a recovery.

Leading up to Black Tuesday, the stock markets were generous. Young and old invested daily in stocks, a numbers game. Dreams of becoming wealthy played in the hearts of everyday workers who shined shoes on New York’s corners to the farmers that lovingly tended wine grapes in the vineyards in northern Italy. Darkness loomed around September 4, 1929, and the worldwide equity value began its slide. During this global financial meltdown, the world lost 50 percent of its wealth.

Loss in lifetime savings to the working class was brutal. Farms owned for generations lay barren and abandoned. The demand side of economics failed. Consumption of goods dropped, and hardship endured for over a decade. The 1929 era marked the beginning of a deep depression led by the United States. It witnessed 25 percent of unemployment for America’s population. An estimated 33 percent of Europe’s populace stood on breadlines. Once again, in November 2008, the United States faced the prospect of another financially-led economic depression.

Untethered by the rules or regulatory procedures legislated after the first crisis in global wealth. This time monetary regulatory safety nets created after the last depression failed to ensure the financial life of nations. So making soft economic landings fell to the International Monetary fund IMF and the European Central Bank ECB global wealth. They monitored money flows and, in some cases, made currency available. They became the influencers of global wealth, with a French woman at the helm of the IMF.

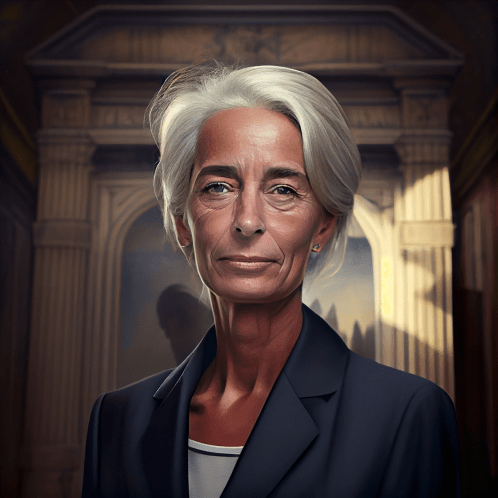

Stately beauty and understated elegance best describe the French woman who approached the Falk Auditorium podium at The Brookings Institution on April 12, 2012. Madam Christine Lagarde, Managing Director of the International Monetary Fund (IMF). Former Finance Minister under France’s Sarkozy, her influence drives the conduct of global wealth. She replaced French Economist Dominique Strauss Khan, who stepped down as IMF chief after a series of sex scandals. The daughter of a Professor of English father and a schoolteacher mother. Christine Lagarde became a divorced mother of two young adult sons. She now lives with her partner, entrepreneur Xavier Giocanti. A competitive swimmer vegan who never consumes alcohol. Christine Lagarde’s brilliance has enabled a life lived on her terms. Forbes named her one of the world’s most powerful women.

A woman that practices positive thinking, Christine Lagarde’s approach to salvation in the current geo-economy is entitled.

“Seizing the Moment – Think beyond the Global Crisis.”

Her presentation at the Falk Auditorium at The Brookings Institution outlined current economic affairs and goals. The report details how to achieve lasting geo-economic stability and global wealth. She praised the United States, the European Central Bank, and Mario Draghi.

In her former role as the first woman to be in charge of monetary policy in France. Madame Lagarde was also a member of Francois Fillon’s cabinet and featured in Andrew Sorkin’s HBO’s original work “Too Big to Fail.” Her wisdom is legendary. And the liberal IMF Chief is no outsider to Washington DC. In 1974, she lived in the nation’s capital as congressional assistant to Representative William Cohen, a Republican from Maine. In 1981 as a member of the Paris Bar, Madame Lagarde joined the international law firm Baker & McKenzie with offices in Chicago, Illinois. As an associate, she specialized in Labor, Anti-Trust, and Mergers & Acquisitions. In 1995, she became a member of the firm’s Executive Committee. Her global influence has grown with each station in her upward climb to heading team IMF.

The world has a rare opportunity. With the looming threat of global financial meltdown, the chance to rebuild lasting geo-economic stability. There was little time to achieve this success. It would require the collaborative efforts of the worldwide collective.

Creating more aggressive social programs will be one of the most important and needful new economic constructs.

New economic infrastructures would assist in designing ways for socioeconomic mobility for the populace, a vital component for actual recovery and growth. Furthermore, the availability of education must become a priority to promote healthy competition and robust national growth. Science, Technology, Engineering, and Mathematics or STEM workforces are paramount to achieving global parity and socioeconomic mobility to the growing worldwide poverty.

Global wealth must share to attain a solid footing in creating sustainable economic growth and prosperity.

A sustainable economy is necessary to develop a medium and long-term growth model for recovery. A social and monetary mechanism must assist the disenfranchised in finding upward mobility. This government initiative must contain vital reforms and financial support to lessen taxpayer opportunity costs. Ignoring these mandates will result in significant sovereign loss.

Global wealth leaders must possess the innate ability to engage with other countries as isolationist policies stifle the competitiveness needed for global economic growth. There must be coordinated regulations that are borderless. This transformative behavior opens doors to those emerging markets that must play a more prominent role in global affairs.

After two decades of robust international commerce, emerging markets represent 50 percent of global growth.

Inviting new players to the G20 table, India and China, is part of achieving geo-economic stability. Their achievements in reaching parity in global wealth have earned them the right to arbitrate new monetary policies. Christine Lagarde explains that we must also appreciate how the world is already participating in collaborative efforts. One example was the announcement in December 2011, where Japan and India unveiled a new currency swap agreement that eased their short-term liquidity woes. The currency swap of yen and rupee for US dollars allowed them to tap into each other’s foreign exchange reserves. This teamwork among countries exemplifies how coordination within global leadership can achieve geo-economic success.

Madam Lagarde explains that her suggestions for global economic stability are sovereign-specific. Where some countries are lagging, others are excelling. There must be quick and coordinated action. As a team, geopolitical leaders must act confidently and not dwell too long on one failed solution. That same answer may be a means of rectification in diverse scenarios. Each resolution is country and economy specific. Germany’s determination will not contain solutions readily embraced by the Greek populace. Alternatively, China’s imports should begin to match its exports and raise the level of its domestic consumption.

Future monetary crises can be kept at bay when we create new economies. In closing, Christine Lagarde quoted Nelson Mandela,

After climbing a great hill, one only finds that there are many more hills to climb.”

Nelson Mandela

For Surface Earth 2012-2013

One response to “The French Woman Who Influences Global Wealth”

[…] The French Woman Who Influences Global Wealth […]

LikeLike